2024 Schedule 1040 Schedule 1040

2024 Schedule 1040 Schedule 1040 – Similarly, if they worked as an independent contractor and were paid with digital assets, they must report that income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). . If you’re new to gambling, you may be surprised to learn that no matter the size of the winnings, whether cash or noncash, they must be reported to the IRS. .

2024 Schedule 1040 Schedule 1040

Source : www.irs.govAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

Source : www.investopedia.comForm 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions

Source : www.incometaxgujarat.orgForm 1040: U.S. Individual Tax Return Definition, Types, and Use

Source : www.investopedia.com1040 (2023) | Internal Revenue Service

Source : www.irs.gov2024 Form 1040 ES

Source : www.irs.gov1040 (2023) | Internal Revenue Service

Source : www.irs.govForm 1040: U.S. Individual Tax Return Definition, Types, and Use

Source : www.investopedia.com1040 (2023) | Internal Revenue Service

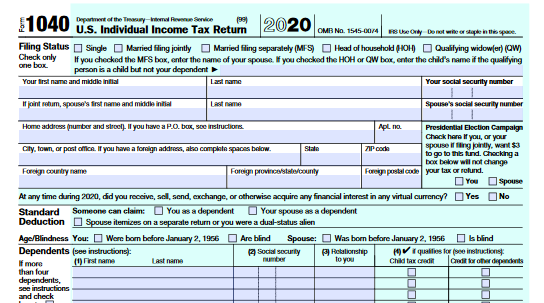

Source : www.irs.govPrintable IRS Form 1040 for Tax Year 2020 CPA Practice Advisor

Source : www.cpapracticeadvisor.com2024 Schedule 1040 Schedule 1040 U.S. Individual Income Tax Return Income: You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. . Your 1040 will come with a number of schedules – like Schedule 1 and Schedule A – that are additional forms. Think of the 1040 like a math worksheet: You plug in various numbers from a .

]]>:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)

:max_bytes(150000):strip_icc()/Screenshot2023-12-15at12.57.18PM-4df7a66986cf4a1ab5cc962b78b698fd.png)

:max_bytes(150000):strip_icc()/1040.asp-final-8113a173a9ce4bf699ffe7e1a5b47156.png)